Market Recap

The year wrapped up nicely for US stocks with the S&P 500 rallying 25.02%. It was another year of high double-digit gains. International markets, however, lagged tremendously relative to the US, up only 3.82%. Bonds, as measured by the Aggregate Bond Index, ended the year up 1.25%.

In 2024, US large-cap stocks was the highest returning asset class. With the returns as they were, any diversified portfolio comprising of US and international stocks and bonds, underperformed US stocks. It is important to understand that this significant outperformance in a certain asset class happens from time to time. However, diversified portfolios offer a better risk adjusted return in the long run as one asset class cannot continue to outperform year after year.

The recent rally in technology stocks around artificial intelligence seems to parallel the networking and internet stocks in the late 1990’s. We have significant concerns about the valuation of these technology companies and their continued run up in price.

2024 Election Recap

The major US stock indices responded positively to the November elections with many reached all-time highs shortly after the elections. Since then, the post-election highs have simmered down. We believe the markets rallied because the unknowns surrounding who will be president and the political makeup of Congress has been resolved. However, this poses new questions for 2025, mainly surrounding taxes and economic policies.

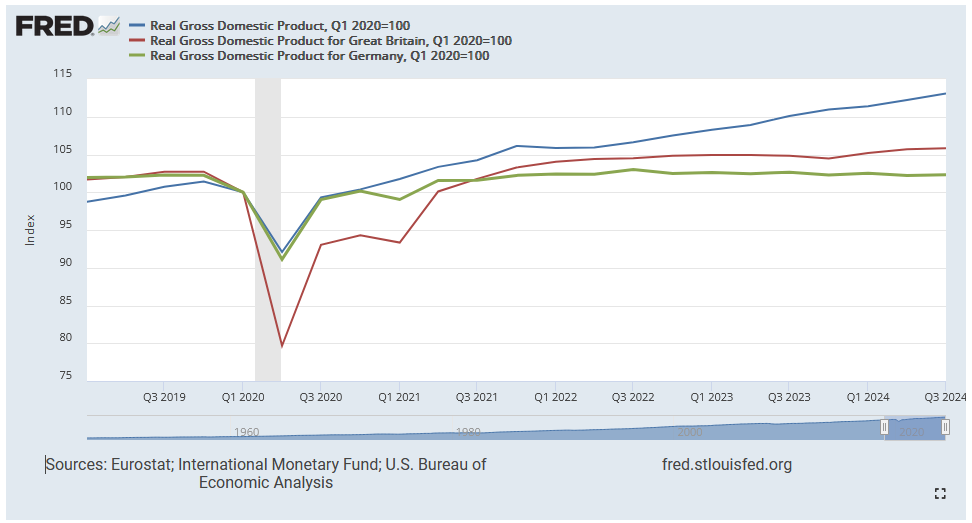

With the Trump administration coming in, it got us reflecting on Trump’s prior term and the potential for tariffs. We wrote at length about tariffs in our Q1 and Q2 2018 newsletters, which are linked here. Tariffs act as a tax to consumers and would add significant pressures to world trade. If substantial tariffs are enacted by the incoming president and Congress, it could negatively impact the world’s economy causing an economic slowdown for everyone. The world economy remains fragile. The US seems to have the strongest economy right now due to the makeup of our economy, which is roughly 2/3 consumer based. The strong consumer demand post COVID restrictions pushed the US economy to recover at a faster rate than externally financed economies such as the Eurozone.

GDP Real Growth Eurozone vs. US 2020 to 2024 (FRED, 2024)

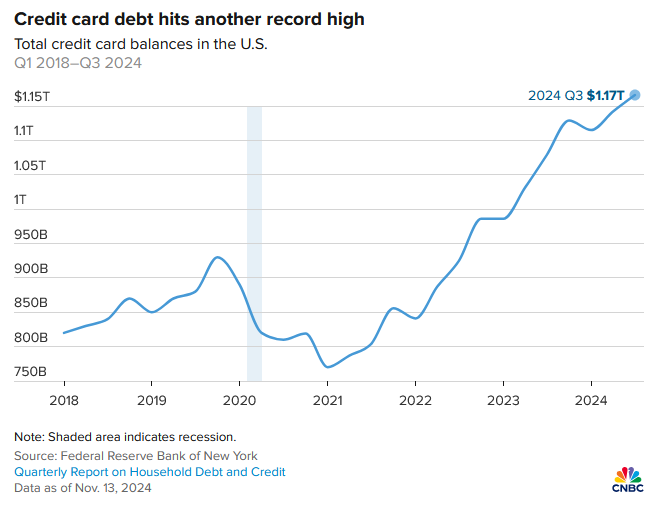

Data seems to suggest that the strong consumer demand is fueled by more borrowing. The credit card debt balance in the US now totals over $1.17 trillion, substantially higher than the pre-pandemic high of $925 billion. Debt-financed growth cannot continue indefinitely as people are limited by their income and cannot continue to borrow more and more money. We think that the consumer is relatively tapped in their ability to borrow and that any hiccup in the economy will be extremely problematic for overleveraged consumers.

Credit Card Debt 2018 to 2024 (Dickler, CNBC, 2024)

Interest Rate Outlook

As widely expected, the Fed cut the benchmark rate by 25 basis points at the recent December meeting. This move is the follow-up to the central bank’s November 25-basis-point and supersized 50-basis-point cut in September and brings the current overnight target lending rate range to 4.25% – 4.50%.

Longer term rates have not decreased, in fact, the 10-year Treasury rate has increased from 3.61% on September 16 to 4.57% on December 31st. Mortgage rates are strongly associated with longer term bonds such as the 10-year Treasury. Thus, mortgage rates similarly increase from 6.08% to 6.85% over the same period. We do not anticipate mortgage rates decreasing with additional incremental Fed rate cuts. The market seems to have deemed ~6.5% 30-year mortgage as the new normal until there is a drastic rate cut responding to an economic recession.

Adjustments for 2025

Effective December 2024, Social Security beneficiaries will see a 2.5% cost of living adjustment (COLA) increase to help offset inflation and support their financial needs. Those currently on Social Security benefits will see an increase in their benefits with the January 2025 payment. Those who are not currently on Social Security, note that the maximum earnings subject to Social Security tax will increase to $176,100, up from $168,600 in 2024. Similarly, the standard deductions and marginal tax brackets have been adjusted for COLA.

Individuals aged 60 to 63 can contribute up to an additional $11,250 under the new “super catch-up” contributions, raising the total limit to $34,750. If you’re eligible and have sufficient cash flow, consider maximizing contributions now, as the super catch-up ends at age 64.

Outlook Ahead

We are following in the footsteps of the Fed, letting data drive our decision-making process. Our known concerns for this year are the federal budget, spending, interest rates, inflation, and economic growth. Emerging markets such as China seems particularly weak. According to a recent Barron’s China’s Economy Ends Year with a Whimper article, “The long-awaited recovery in consumer spending it was intended to generate has yet to materialize in a sustainable way. Sales volume in every sector within retailing declined relative to both the prior month and 12 months earlier.” (Kapadia, Barrons, 2024). Economists are projecting a substantial stimulus package in China to boost its GPD. However, if there are substantial tariffs, it could be extremely problematic for the world’s second largest economy and potentially our own as well.

Thank You

As always, we greatly appreciate the confidence you have placed in us to work alongside you as you financially prepare for your future. We hope that you’re staying healthy and taking good care of yourself.

If you have any questions or concerns, please contact us and we will be happy to meet with you and review or refresh your overall plan. Follow us on Facebook, LinkedIn, and Twitter, as well as our RSS feed, to stay up to date on what we’re reading and thinking. Thank you so much for the opportunity to work alongside you.