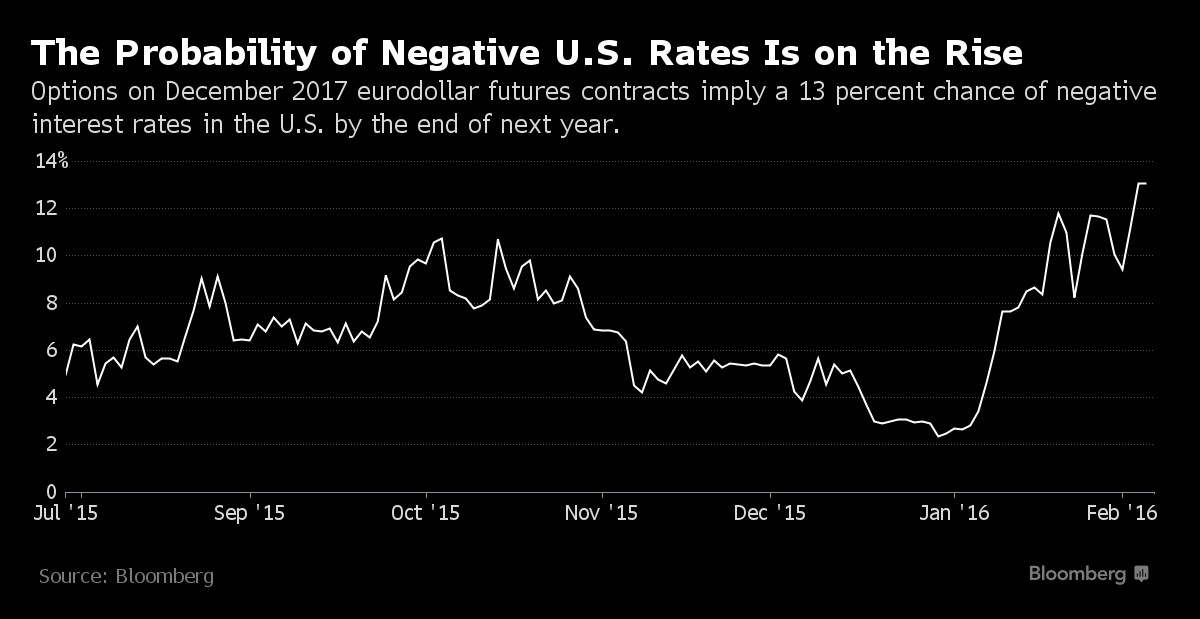

Global central banks have opened the door to negative U.S. interest rates, in Wall Street’s view.

After the Bank of Japan cut some rates below zero last month to spur growth and inflation, strategists are weighing the Federal Reserve’s options in case of a crisis. If the world’s biggest economy weakens enough that traditional policy measures don’t help, the Fed may consider pushing rates below zero, according to Bank of America Corp. and JPMorgan Chase & Co.

Alexandra Scaggs | Bloomberg News