2025 Market Snapshot

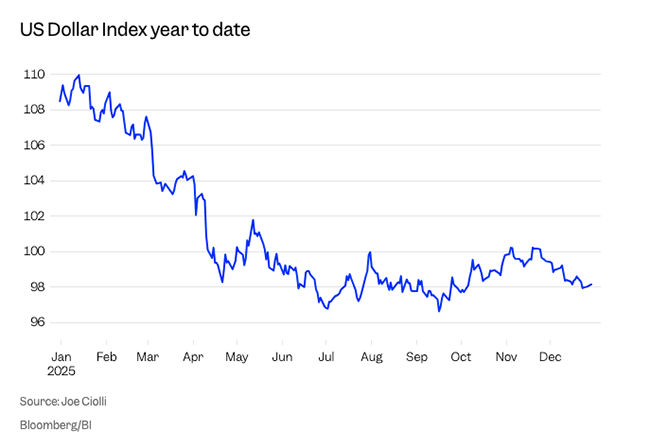

For the year, US equities, as measured by the S&P 500, posted a 17.9% gain. International equities, captured by the MSCI EAFE, outperformed markedly, delivering a 31.2% return. This excess is largely attributable to a 10% depreciation of the US Dollar against a basket of major currencies – the steepest decline since the post-Bretton Woods era of 1973 – which magnified foreign-listed assets when converted back to US dollars.  Figure 1: 2025 USD against a basket of foreign currencies

Figure 1: 2025 USD against a basket of foreign currencies

Fixed-income markets also performed well, with the Bloomberg Aggregate Bond Index climbing 7.3%. Rising demand for safe-haven assets, coupled with falling Treasury yields, helped lift the bond benchmark, reflecting investor caution amid the fiscal uncertainties introduced by recent tax legislation.

Tax Update – What You Need to Know

401(k) & Catch-Up Rules

The 2025 contribution ceiling is now $24,500. Additionally, if you’re over 50, you can make an additional catch-up contribution of $8,000. We have received word that some employers are forcing the catch-up contribution as Roth 401(k) contributions for high-income earners in 2026. However, starting in 2027, all high-income earners must contribute the catch-up contributions as Roth. Those in the 60-63 age bracket get a further lift: catch-ups rise to $11,250 (up from $8,000).

State and Local Taxes Limits

The state-and-local-tax (SALT) deduction cap that sat at $10,000 since the 2017 Tax Cuts and Jobs Act has been increased to $40,000, with a 1% annual increase thereafter. This opens the door for high-tax-state residents to itemize more aggressively, trading the standard deduction of $15,750 (single) / $31,500 (married) for a larger SALT write-off. Keep in mind: the cap phases out between $500,000 and $600,000 modified adjusted gross income for both filing statuses. In 2030, the SALT deduction cap will revert to $10,000.

Charitable Deductions

OBBBA re-introduces a pandemic-era break for charitable giving. While 2020-21 let non-itemizers claim $300 per person, the new permanent rule will let single filers deduct up to $1,000 in cash gifts and married couples $2,000. For itemizers, a 0.5 % AGI floor now applies, so on a $100,000 AGI, only the amount over $500 is deductible. Those in the top bracket will see all deductions treated as if they were in the 35 % bracket, capping a $1,000 donation to a $350 deduction instead of $370.

You may also give directly to a charitable organization through your IRA if you’re over 70½. These types of qualified charitable distributions (QCD) are the most tax-efficient way to give, as the QCD from the IRA is not taxed.

Trump Accounts – A New “Kid IRA”

Children born between 2025-29 will get a $1,000 government seed deposit into a special IRA-style account. We anticipate clarification on the logistics of these Trump Accounts by the middle of 2026. We will update you when we know more.

After July 4, 2026, parents, employers, charities, and the state can top that up with after-tax contributions up to $5,000 a year until the child turns 18. Earnings grow tax-free, but the fund must stay in low-cost U.S. equity indexes. When the kid turns 18, the account rolls into a traditional IRA, and withdrawal rules kick in. Because the original deposits are after-tax, any withdrawals will be taxed only on the earnings portion. For families with young children, this is a powerful and low-friction saving tool, especially if cash flow allows.

The Current Landscape

The past two years have been a whirlwind of headlines, record-breaking fundraising, and a rush of capital into a handful of AI-centric companies. CoreWeave’s IPO, the largest for a tech start-up since 2021, doubled its share price in a few months, and the company is now touting a $22 billion partnership with OpenAI, a $14 billion tie-up with Meta, and a $6 billion deal with Nvidia. All of this is happening while CoreWeave carries a staggering $20 billion in operating costs against $5 billion in expected revenue, and a debt load that is set to balloon by $14 billion within the next year (Karma, 2025).

The AI sector is not an isolated bubble. The same pattern of circular financing, special-purpose vehicle (SPV) structures, and private-credit debt that has been brewing in the data-center and chip-manufacturing arms is permeating the broader tech ecosystem. Amazon, Google, Microsoft, Meta, and Oracle are all building or leasing new data-center facilities at a multibillion-dollar scale, and each of these companies is leveraging private-equity lenders, SPVs, and even graphics processing unit (GPU) backed loans to do so. The result is a web of interlocking, high-leverage obligations that are invisible on the surface of corporate balance sheets but become exposed when the AI economy’s profitability falters.

Valuation Concerns

If we look at the market as a whole, the S&P 500’s 17.9 % return last year was fueled in part by a surge in technology shares. Yet, if you strip out the AI-heavy components (Microsoft, Nvidia, Meta, Alphabet), what remains is a relatively modest 9–10 % gain. Even within the AI-segment, we see valuations that are doubling the traditional price-to-earnings multiples of comparable, profitable firms.

CoreWeave’s valuation is especially striking when you consider that it had zero profits and a ledger of billions of dollars in debt when it went public. Its share price has outperformed the “Magnificent Seven” purely on the back of hype, which is a classic valuation red flag. The same is true for OpenAI and Anthropic: both are operating at a projected net loss of $15 billion dollars this year and will not break even until at least 2029. Yet, Nvidia’s chip sales have been buoyed by the belief that every AI company will eventually generate “record-shattering profits.” The market, for now, is essentially betting that a single, high-growth technology company will become a giant, profitable conglomerate overnight.

The danger of this mindset is not new. It echoes the 2008 financial crisis, where an avalanche of highly leveraged loans and complex securitizations were built around the subprime mortgage market. Those deals, once unraveled, sent shockwaves through banks, insurers, and pension funds. The AI build-out is happening at a scale that could dwarf the dot-com crash, and the debt that is being used to finance it is coming from private-credit firms—an increasingly opaque component of the financial system.

Circular Financing: What It Means for Investors

CoreWeave’s business model is deceptively simple: purchase or lease high-end chips, build or lease data-center space, and rent the capacity to AI firms. But the execution is anything but simple. Nvidia supplies chips and simultaneously invests in CoreWeave, while Microsoft supplies the majority of CoreWeave’s revenue (70 % of the bill). OpenAI is a major investor in CoreWeave and, at the same time, a major customer for Nvidia. These circular financing deals create a loop where one company’s future earnings are used to fund the other’s infrastructure—often through SPVs that keep the debt off the sponsor’s balance sheet.

Meta’s Louisiana data-center project, financed by Blue Owl Capital through an SPV, is a textbook example. Blue Owl borrows on Meta’s behalf, builds the facility, and leases it back to Meta. This keeps the debt off Meta’s books, allowing it to maintain a low-rated borrowing profile while still loading on the same liabilities that would otherwise push its leverage to unsustainable levels.

These structures are attractive because they allow firms to maintain low leverage ratios on paper and secure low-interest rates from private-credit lenders that are largely exempt from traditional banking oversight. However, the same techniques that were used to mask the liabilities of Enron in the 2000s are now being used to mask a new system of risk—one that is not guaranteed to be paid back until the AI services generate significant cash flow. If the rate of growth for AI services stalls—as early indicators suggest a potential slowdown in productivity enhancement, every SPV and private-credit facility could become a ticking time bomb.

The Debt Trap and Real-Economy Implications

Private-credit debt in the AI sector is already projected to exceed $2.8 trillion by 2028 (Morgan Stanley, 2025). That is a sizeable fraction of the total private-credit market and will be spread across a web of entities that include pension funds, university endowments, and hedge funds. When a large number of these highly leveraged loans default simultaneously, the fallout can be much worse than a simple equity correction. The real-economy impact is amplified because AI infrastructure is far more expensive than in the dot-com era; data-center spending is now projected to exceed $400 billion in 2025, roughly the size of Denmark’s GDP, and $7 trillion by 2030 (McKinsey, 2025).

If chip prices were to collapse—older GPU models devaluing faster than we currently anticipate—GPU-backed loans would be called in before the companies have the cash to pay them. The result is a cascading effect: lenders call in debt, chip prices plummet, other lenders call in, and the market gets flooded with GPUs, further driving prices down. A private-credit bust, while preferable to a bank crisis in theory, would still erode confidence in the financial system and could ripple through insurers and major banks that have long-standing exposure to private-credit funds.

Systemic Risk: A Broader Perspective

Regulators are still grappling with the true interconnectivity of private credit to the broader financial system. The Federal Reserve estimates that up to 25% of bank loans to nonbank financial institutions are now made to private-credit firms, up from a mere 1% in 2013. Life-insurance companies alone hold nearly $1 trillion in private credit. Thus, an AI-related debt default could feasibly trigger a wave of private-credit failures, subsequently pressuring banks and insurers that are integral to the U.S. economy.

The current executive order loosening restrictions on 401(k) investors to invest in alternative assets, including private credit, has only magnified the exposure of ordinary investors to this systemic risk. While the upside of private-credit investing can be enticing, it is critical to remember that pension funds and university endowments are already the most vulnerable stakeholders. The potential for a cascade of failures is real, and the consequences for your portfolio could be substantial.

What Should We Do?

- Re-evaluate Growth-Weighted Portfolios

If your portfolio has grown heavily in tech and AI shares, consider a graduated exit strategy that reduces exposure as valuations rise. Diversify into non-tech sectors that are less exposed to the high-leverage AI web, such as healthcare, consumer staples, or utilities. - Stress-Test Your Allocation

We can run scenario analyses where the market declines by 25% or whatever drawdown and observe the ripple effect on your portfolio, especially if you hold a concentration in technology companies. - Consider Alternative Asset Allocation

Some clients prefer to maintain a higher allocation to “alternative assets.” However, in the face of a potential systemic shock, a defensive tilt toward high-quality bonds and cash equivalents could provide liquidity and preserve capital.

Bottom Line

We are witnessing a double-or-nothing bet on a technology that is not yet profitable. The AI sector’s heavy reliance on SPVs, circular financing, and private-credit debt mirrors the financial practices that foreshadowed the 2008 crisis. If the AI revolution does not deliver the promised productivity gains, the repercussions could be far more severe than the dot-com crash of 2000. Even if an equity correction is the least of our worries, a systemic debt default could trigger a recession that reverberates throughout the financial system.

High net worth families and sophisticated investors deserve a candid assessment of this risk. We must not be lulled by the dramatic valuations or the hype surrounding AI infrastructure. Instead, we should be proactively managing leverage, diversifying exposure, and building liquidity buffers that can absorb a sudden market shift.

We invite you to schedule a portfolio review so we can evaluate your exposure to AI-heavy assets and private-credit instruments, assess your risk tolerance, and determine if a more balanced allocation is warranted. Let’s stay ahead of the curve and ensure that our wealth strategy remains resilient in the face of the next financial storm.

Disclosure: Archvest does not recommend individual equity positions. The company names referenced in the Current Landscape section of this newsletter are for reference only and are necessary to highlight the current AI market. This is not a buy or sell recommendation.

Citations:

2025 Capital Markets Rebound & Trends | Morgan Stanley. (n.d.). Morgan Stanley. https://www.morganstanley.com/insights/articles/capital-markets-outlook-2025

Karma, R. (2025, December 12). Something ominous is happening in the AI economy. The Atlantic. https://www.theatlantic.com/economy/2025/12/nvidia-ai-financing-deals/685197/

McKinsey & Company. (2025, April 28). The cost of Compute: a $7 trillion race to scale data centers. https://www.mckinsey.com. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-cost-of-compute-a-7-trillion-dollar-race-to-scale-data-centers

Sor, J. (2025, December 29). The dollar has been the weakest major currency in 2025. Here’s what that means for everyday Americans. Business Insider. https://www.businessinsider.com/weak-us-dollar-usd-decline-impact-on-americans-inflation-2025-12