Market Review

Overall, the markets remained relatively flat or even slightly positive heading into September. However, volatility picked up once Congress got back in session. September was a negative month bringing the S&P 500 +.58% and the Dow -1.46% for the quarter. International markets were also slightly negative at -.45%.

Congress is currently dealing with some very important issues including: the debt ceiling, passing a budget through the reconciliation process, more debt spending, and tax legislation. Some of these proposed changes may impact your tax situation. Thus, some of these items should be addressed as soon as possible before tax legislations change. Additionally, Jerome Powell indicated the Federal Reserve will start tapering as early as next month, reducing the amount of being borrowed by the Fed and slowing the monetary expansion. This would mean a reduction of liquidity in the system but should not have a significant impact on the economy.

In addition, the labor market remains weak. Businesses are facing significant problems recruiting new employees. According to the most recent payroll data, roughly 5 million workers are still missing from the job market. The Federal Reserve’s balance sheet has expanded two-fold within a short period of time and more people need to be working for the economy to continue its expansion. The economy must grow significantly to justify this monetary expansion. Yet as the economy is recovering, the average US consumer remain under pressure.

Taxman Update

Here’s a summary of the latest proposed tax legislation from Congress:

“Let me tell you how it will be,

There’s one for you, nineteen for me,

‘Cause I’m the taxman,

Yeah, I’m the taxman,

Should five percent appear too small,

Be thankful I don’t take it all,

‘Cause I’m the taxman,

Yeah, I’m the taxman…”

Harrison, George, Taxman, 1966.

In recent years, our debt has exploded through a combination of the COVID crisis and the unfunded tax cuts from 2017. The only way to address this is through substantial economic growth and increased taxes. The proposed legislation includes provisions to increase top marginal tax rates, increase corporate tax rates, and rework how capital gains will be taxed. The House Ways and Means Committee’s proposal is 800-pages, so there’s a lot to digest. We’ll share with you some key takeaways:

- The “back-door” Roth strategy will be going away. Specifically, no conversions of after-tax dollars will be allowed, period. The proposal would prohibit after-tax IRA and plan contributions from being converted to Roth, regardless of income level. Some of you are maxing out your retirement plan as well as contributing after-tax dollars, which get converted to the Roth. If the legislation passes, this will cease.

- The current gift and estate tax exemption is $11.7 million per person, which shelters over 99.9% of estates from estate tax. If Congress does nothing, under current law the exemption will revert to $5 million per person, indexed for inflation in 2026. The proposed legislation would accelerate this reversion, making it effective for estates of decedents dying and gifts made after Dec. 31, 2021. The portability of estates for married couple is not addressed. The portability was signed into law by President Obama under the American Taxpayer Relief Act in 2013. Since this was a separate law, Congress must take active steps to overturn it in order for it to go away. If the proposed legislation does not contain language to overturn the portability, we can assume that it will continue.

Chinese Debt Crisis

The biggest threat to worldwide economies right now is China The latest default of Evergrande is the latest symptom of the underlying crisis. China has a debt problem that the world does not fully comprehend. This is due to the lack of transparency by the Chinese government. Almost all statistics coming out of China are from the central government and approved by the Chinese Communist Party (CCP). The two are the same in China, so we’ll refer to the government as the CCP. The CCP does not allow these statistics to show a different picture than the party line and there is strong evidence that there is manipulation of the data. According to a recent study by Professor Frank Zhang of Yale University, “Chinese governments often inflate GDP figures in order to meet targets. Some officials may do so by pushing through projects without long-term economic value, such as unnecessary infrastructure investments, while others fabricate numbers outright.”

China’s growth in recent years has been financed by debt. To fully understand why this is the case, it is important to understand how governments and corporations run in China. Here’s a simplified version of what’s happening:

- Large Chinese banks are sanctioned and owned by the CCP.

- Local governments oversee their own finances. As there is a need for money, local governments can “sell” land to developers to raise cash. “Selling” land is one of the primary funding mechanisms of local governments.

- Developers borrow money (often from Chinese banks) to purchase land from local governments.

- Developers develop the land and sell the properties to Chinese consumers who purchase these properties through cash and borrowing (again from Chinese banks).

- Local governments will eventually need more cash and need to “sell” more land repeating the cycle.

This cycle of finance needs to continue or the whole system will collapse. Thus, there is incentive for everyone through the entire value chain to keep it going, regardless of economics. When these improper incentives are in place, it encourages “bad” investments as Professor Zhang summarized.

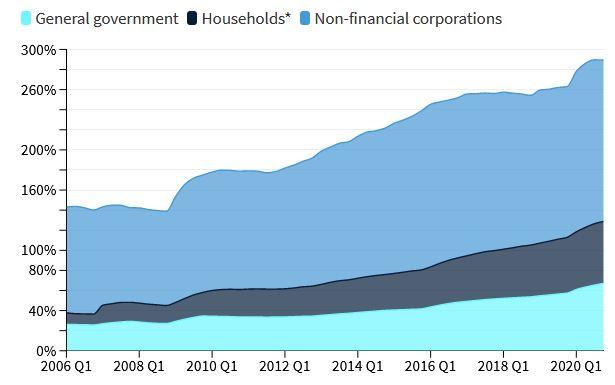

According to the data, the largest borrowers are non-financial corporations. See the chart below. However, the true bearer of default risk are the Chinese banks and the CCP (see point #1 above).

Source: Bank of International Settlements and CNBC, June 2021

The threat to world economies is contagion. Contagion is defined as spread of an economic crisis from one market or region to another. If the debt crisis in China cannot be contained by the CCP, contagion could spread into other markets. It does appear that the default of Evergrande is contained for now. However, as more developers run into financial problems and default, it will become harder and harder for the CCP to contain.

Office Hours

We are still working in the office on rotation and plan to keep meetings online with clients through the remainder of the fourth quarter and into the first part of 2022. We will notify everyone when we resume regular hours. We look forward to seeing you in person again. Please stay safe and healthy.

As always, we greatly appreciate the confidence you have placed in us to work alongside you regarding your planning needs. Be sure to follow us on Facebook, LinkedIn and Twitter as well as our RSS feed to stay up to date on what we’re reading and thinking.

The Archvest Team